One trader made a well-timed bet that Microsoft Corp.’s $69 billion bid to acquire Activision Blizzard Inc. would get the okay to move forward from a US court Tuesday.

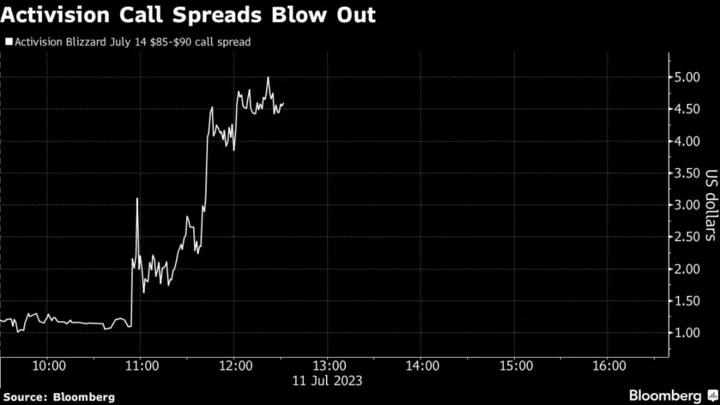

A block trade of 2,000 Activision call spreads — which would gain in value as the shares rise — was reported about 10 minutes before the company’s shares spiked when a US judge denied the Federal Trade Commission’s request to halt the deal.

The spreads, which are equivalent to 200,000 shares, traded for $1.20 each at 10:44 am New York time. They were worth about $4.15 an hour later after shares rallied as much as 12%, potentially netting the buyer about $600,000 in profits.

READ: Microsoft Wins US Court Nod to Buy Activision in FTC Loss

The spread between Activision’s stock price and the $95-a-share takeover offer narrowed to the smallest ever — from $12.70 at Monday’s close to less than $3 by noon Tuesday in New York. It’s been one of the most popular positions for merger arbitragers this year, with traders even flocking to the San Francisco courtroom to follow the proceedings in person. By the end of last month’s court hearing, a consensus was emerging among arbitragers that the FTC was unlikely succeed in its efforts to scuttle the deal.

READ: Microsoft-Activision Trial Has Merger Arbitragers Glued to Court

Overall options volumes surged to more than four times normal levels Tuesday, with shares continuing to rise after the UK’s Competition and Markets Authority and the two companies submitted a request to stay litigation in the UK, offering further optimism to that the deal would go through. Implied volatility — a key measure of options value — fell, indicating traders who had put on bullish positions may be taking some profits on the rally.

--With assistance from Yiqin Shen.